$300 charitable deduction 2021|$300 charitable contribution deduction : Clark Subject to certain limits, individuals who itemize may generally claim a deduction for charitable contributions made to qualifying charitable . Tingnan ang higit pa In this article. This topic applies to Dynamics 365 Customer Engagement (on-premises). For the Power Apps version of this topic, see: OData v4 Data Provider configuration This topic describes how to configure the OData v4 data provider as well as the requirements and recommended best practices for using the OData v4 data provider to connect with .

PH0 · irs charitable tax deduction 2021

PH1 · charitable donations 2021 standard deduction

PH2 · charitable deduction 2021 standard deduction

PH3 · cash charitable deductions 2021

PH4 · Iba pa

PH5 · 2021 charitable tax deductions allowed

PH6 · 2021 charitable deduction without itemizing

PH7 · $300 non itemizer charitable deduction

PH8 · $300 charitable contribution deduction

Iba-iba ang gamot saskin asthma o eczema. May mga gamot na nagmo-moisturize ng dry at makating balat. Ang ibang mga gamot ay nilulunasan ang pamamaga, tulad ng steroids. At ang lunas .

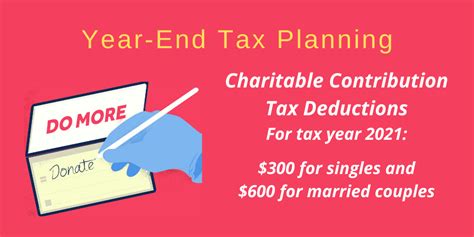

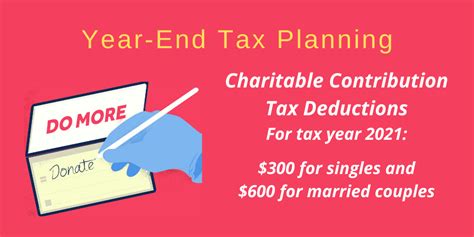

$300 charitable deduction 2021*******The IRS explains the expanded tax benefits for individuals and businesses who donate to charity in 2021. Non-itemizers can claim a deduction of up to $300 for cash donations to qualifying charities, and itemizers can apply an increased limit of up to 100% of AGI for qualified contributions. Tingnan ang higit pa

Ordinarily, individuals who elect to take the standard deduction cannot claim a deduction for their charitable contributions. The law now permits these . Tingnan ang higit paSubject to certain limits, individuals who itemize may generally claim a deduction for charitable contributions made to qualifying charitable . Tingnan ang higit paThe law now permits C corporations to apply an increased limit (Increased Corporate Limit) of 25% of taxable income for charitable contributions of cash . Tingnan ang higit paThe IRS reminds individuals and businesses that special recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction. . Tingnan ang higit pa

Learn how to deduct up to $300 in cash donations to eligible charities in 2021, even if you take the standard deduction. Find out the requirements, exceptions . Learn how to get a $300 (or $600) tax deduction for cash gifts to qualified charities if you take the standard deduction in 2021. Find out the eligibility, limits and .

These individuals, including married individuals filing separate returns, can claim a deduction of up to $300 for cash contributions made to qualifying charities during 2021. .$300 charitable contribution deduction Learn how to claim a special tax rule that allows you to deduct up to $300 ($600 for married couples) for donations to qualifying charities in 2021. You don't have . Internal Revenue Service officials and non-profit groups are seeking to drum up awareness for a relatively unheralded benefit of COVID-19 relief legislation - a $300 .

The $300 above-the-line charitable deduction has been extended for single filers who do not itemize deductions. For 2021, this above-the-line deduction is increased to $600 for .The result is your charitable contribution deduction to charity X can’t exceed $300 ($1,000 donation−$700 state tax credit). The reduction applies even if you can’t claim the state .

In 2020, you can deduct up to $300 of qualified charitable cash contributions per tax return as an adjustment to adjusted gross income without itemizing your .

In March 2020, Congress enacted a $300 charitable deduction for cash gifts from nonitemizers for 2020 and in December 2020 extended its availability through 2021 and .

Above the line deduction for 2020 and 2021 only. In 2020, you can deduct up to $300 of qualified charitable cash contributions per tax return as an adjustment to adjusted gross income without itemizing your deductions. In 2021, this amount stays at $300 for many filers but increases to $600 for married filing joint tax returns. Deductions for Individual Charitable Cash Donations up to $600. Just like last year, individuals, including married individuals filing separate returns, who take the standard deduction can claim a deduction of up to $300 on their 2021 federal income tax for their charitable cash contributions made to certain qualifying charitable organizations. However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction. One donation of $300 may not move the needle much .

WASHINGTON — The Internal Revenue Service today reminded taxpayers that a special tax provision will allow more Americans to easily deduct up to $600 in donations to qualifying charities on their 2021 federal income tax return. Ordinarily, people who choose to take the standard deduction cannot claim a deduction for their .

$300 charitable deduction 2021 $300 charitable contribution deduction The CARES Act and the Consolidated Appropriations Act, 2021 provided for three enhancements to the charitable deduction for 2020 and 2021. First, they provided a deduction for cash donations for nonitemizers of up to $300 ($600 for joint returns for 2021) who take the standard deduction. Second, they eliminated the limit on cash gifts of .

The special $300 charitable contribution deduction is available to individual taxpayers who choose to take the standard deduction rather than itemizing their deductions. So, if you do not file Schedule A, Itemized Deductions, with your 2020 Form 1040 series income tax return, you can still take this $300 deduction ($150 deduction if . Here's how the CARES Act changes deducting charitable contributions made in 2020: Previously, charitable contributions could only be deducted if taxpayers itemized their deductions. However, taxpayers who don't itemize deductions may take a charitable deduction of up to $300 for cash contributions made in 2020 to qualifying . Internal Revenue Service officials and non-profit groups are seeking to drum up awareness for a relatively unheralded benefit of COVID-19 relief legislation - a $300 tax deduction for charitable .

$300 charitable deduction 2021 Internal Revenue Service officials and non-profit groups are seeking to drum up awareness for a relatively unheralded benefit of COVID-19 relief legislation - a $300 tax deduction for charitable .

Watch stunning Russian girls gag and spit on hard cocks in this 18th part of the Youngthroats series. Join the discussion and share your thoughts.

$300 charitable deduction 2021|$300 charitable contribution deduction